Taxpayer Engagement Programme - e-Tax - What Do I Need (Individual)?

INDIVIDUAL ACCESS

To use e-Tax, you need to get your ttconnect ID

Register for your ttconnect ID in three (3) simple steps:

-

Complete and Submit the ttconnect ID Registration Form (www.ttconnect.gov.tt) online. Ensure your BIR number is included in the registration form.

Once completed and submitted, you should receive an email notification with additional registration details. If you do not receive any such notification please send an email to info.ttconnect@gov.tt. -

Activate your ttconnect ID (instructions for activation are contained in the email notification).

-

Visit a ttconnect Service Centre (except Nicolas Towers) with the following forms of valid Identification / Documentation, as well as your ttconnect ID, in order to complete the registration process. Make sure to indicate to the Customer Service Representative that you are enroling for e-Tax.

BIR NUMBER VERIFICATION (ANY ONE OF THE FOLLOWING)

- Advice of BIR or Advice of BIR and Acct Numbers

- VAT Advisory

- Tax Clearance

- Statement of Account

- Notice of Assessment

IDENTIFICATION (ANY TWO OF THE FOLLOWING)

- National Identification Card

- Drivers Permit

- Passport

- Electronic Birth Certificate

- Naturalization Certificate

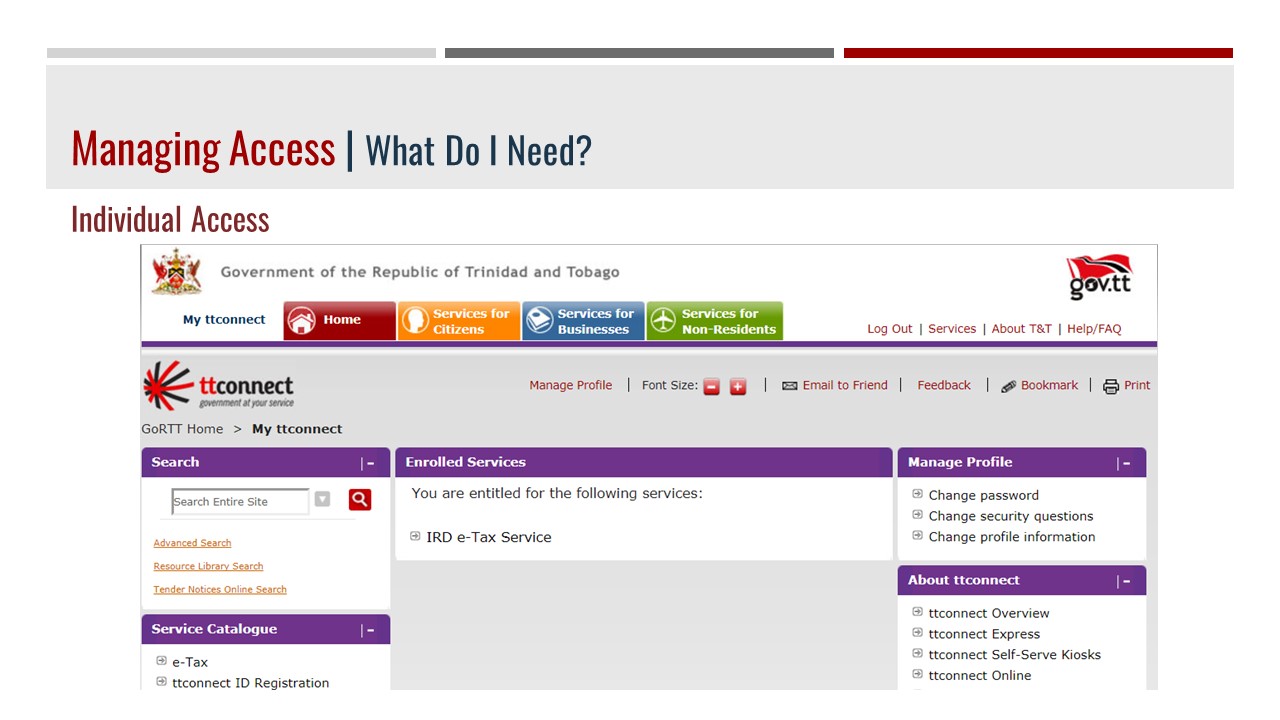

Once enroled for e-Tax, when you log into ttconnect the link to e-Tax will look as follows: