e-Tax - Non-Logged In Returns FAQs

e-Tax - Non-Logged In Returns (37)

-

Q: What is the ‘Non-Logged In Returns Service’?

-

A: This additional service, introduced by the Board of Inland Revenue (BIR), to assist taxpayers who have not yet registered for e-Tax with ttconnect to file their returns on the e-Tax homepage at https://etax.ird.gov.tt.

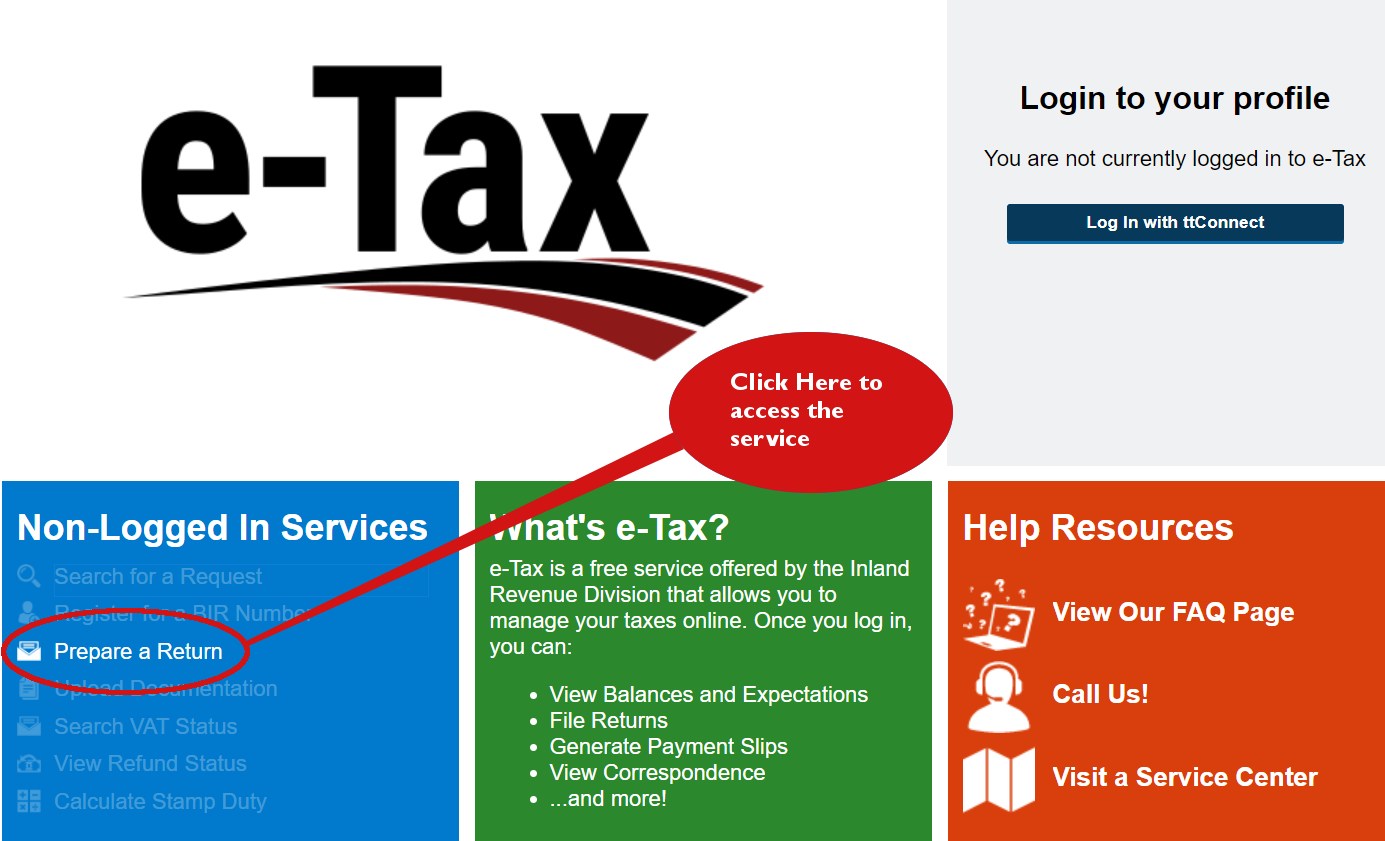

The process for accessing the ‘Non-Logged In Returns Service’ is as follows:

- Have on hand, your BIR file Number, the Account Number of the respective Tax Type and BIR Letter ID Number. (This number can be found on any ‘Official Receipt’ or ‘Advice of Assignment of BIR Number and Account Numbers’ and ‘Notice of Assessment’ for individual income tax)

- Go to https://etax.ird.gov.tt.

- Click on the ‘Prepare a Return’ link, under the Non-Logged In Services section

- Use BIR numbers, listed in (1) above to complete the verification process

- Enter details on return online

- Print ‘Declaration Form’ and Summary

- Review and verify the data entered on the Summary (The Summary is to be retained for your personal records)

- Sign the printed ‘Declaration Form’ and submit same to any of the Division’s Regional or District Revenue Offices. (A full list of office locations can be found at http://www.ird.gov.tt/locations).

Please note that the return cannot be processed without the submission of the signed ‘Declaration Form’.

-

Q: Who can use the ‘Non-Logged In Returns Service’?

-

A: The service is available for the following returns:

- Pay-As-You-Earn (PAYE)

- Value Added Tax (VAT)

- Corporation Tax (CIT)

- Individual Income Tax (IIT)

- Hotel Accommodation Tax (HOT)

- Petroleum Profits Tax (PPT)

- Supplemental Petroleum Tax (SPT)

- Insurance Tax

- Partnership Return

- Financial Services Tax (FST)

- Insurance Premuim Tax (IPT)

-

Q: Which account should I use if I am only paying Health Surcharge for my employees?

-

A: The PAYE account number is to be used.

-

Q: Why should I use the ‘Non-Logged In Returns Service’?

-

A: All taxpayers would be required to file their returns online. This service offers taxpayers a second option to comply, if they are not registered for e-Tax with ttconnect. You are not required to collect blank tax returns from IRD’s offices. The following returns are available on the Non-logged in Service:

RETURN TYPE

FILING YEAR AVAILABLE ON SERVICE

Value Added Tax (VAT)

2019 to present

Pay-As-You-Earn (PAYE)

2019 to present

Corporation Tax

2018 to present

Individuals

- Self Employed

- Emolument Income Earners

2017 to present

Insurance Tax

2018 to present

Partnership

2015 to present

Petroleum Profit Tax (PPT)

2014 to present

Supplemental Petroleum Tax (SPT)

2016 to present

Hotel Accommodation Tax (HOT)

2019 to present

Financial Services Tax (FST)

2019 to present

Insurance Premium Tax (IPT)

2014 to present

-

Q: Do I have to register for the ‘Non-Logged In Returns Service’?

-

A: Taxpayers are not required to register to use this service.

-

Q: Can I use this service if I already have a ttConnectID and access to e-Tax?

-

A: Yes. This service is available to all taxpayers. However, your return will take a longer time to process and you will need to drop off a ‘Declaration Form’. However, if you log in to e-Tax, you can prepare and submit your return immediately, without having to print and drop off the ‘Declaration Form’. If you use the ‘Logged in’ option your return will be processed within twenty-four (24) hours.

-

Q: What are the differences between ‘Non-Logged In service’ and ‘Logged In service’?

-

A: The differences between both services are as follows:

‘Non-logged In service’ ‘Logged In service’ - Service does not require the taxpayer to register for e-Tax via ttconnect

- Returns can only be processed on receipt of a signed ‘Declaration Form’

- Online returns can only be prepared for the years identified above

- No immediate confirmation of return filing

- Cannot view accounts & transactions

- Must visit IRD’s offices to transact business and confirm filing of returns

- No access to the services offered under the ‘logged In service’.

- Service requires registration for e-Tax via ttconnect

- Automatic same or next business day processing

- Online returns can be prepared for any year

- Immediate confirmation of return filing

- Ability to view transactions and filing periods for previously filed returns

- Ability to register for other tax accounts

- Convenience of transacting business without making visits to IRD’s offices

- Access to the services offered under the ‘logged In service’.

-

Q: What do I need to be able to access the ‘Non-Logged In Returns Service’?

-

A: Taxpayers will require the following:

- An active internet connection

- Standard, modern web browser, such as Microsoft Edge or Google Chrome

- Digital scans of any supporting documents

- A pdf reader is required to view or print the return summary and declaration form

- Printer

-

Q: What information will be required to prepare my return using ‘Non-Logged In Returns Service’?

-

A: Before a return can be prepared, the taxpayer must be verified using the following required information:

- BIR File Number

- Account Number for the respective Tax Type

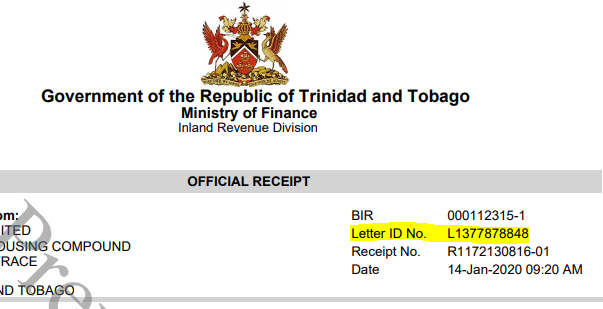

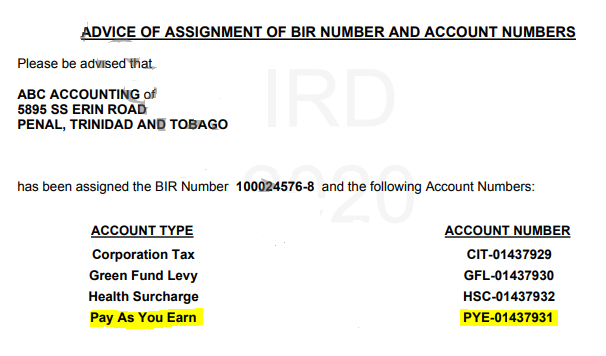

- BIR Letter ID from one of the following

- Advice of Assignment of BIR Number and Account Numbers - Not older than 6 years

- Payment Receipt - Not older than 1 year

- Notice of Assessment (Individual Income Tax only) - Not older than 3 years

-

Q: What letters can be used for the verification process?

-

A: The Letter ID from one the following letter types only, is required to complete the verification process:

- ‘Advice of Assignment of BIR Number and Account Numbers’ - This letter must not be older than six (6) years

- Payment Receipts - The receipt must not be older than one (1) year

- Notice of Assessment (Individual Income Tax only) - This notice must not be older than three (3) years

Please note that Letter IDs from other letter types or from letters older than the period specified are not valid for this service and will not pass the verification process.

-

Q: How can I request a letter to be used for the verification process?

-

A: You may call 800-TAXX - option 1, or visit any of the Inland Revenue Division's (IRD) Regional Offices to request a letter.

-

Q: Where can I find the Letter ID?

-

A: The Letter ID is located on the top right corner of your letter. It begins with an L followed by 10 digits.

-

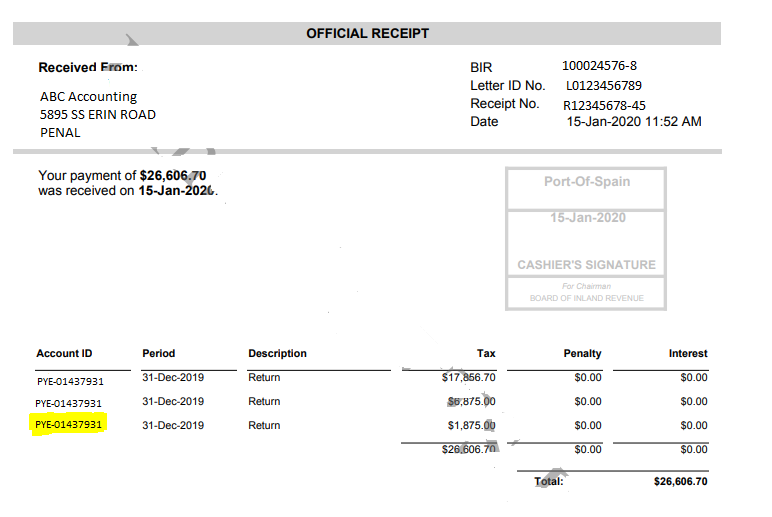

Q: Where can I find my Account Number or ID?

-

A: The account number can be found either listed in the body of the ‘Advice of Assignment of BIR Number and Account Numbers’ document, under the heading Account Number; or on an ‘Official Receipt’, under the heading ‘Account ID’.

-

Q: What are the tax returns and filing periods that will be available online?

-

A:

RETURN TYPE

FILING YEAR AVAILABLE ON SERVICE

Value Added Tax (VAT)

2019 to present

Pay-As-You-Earn (PAYE)

2019 to present

Corporation Tax

2018 to present

Individuals

- Self Employed

- Emolument Income Earners

2017 to present

Insurance Tax

2018 to present

Partnership

2015 to present

Petroleum Profit Tax (PPT)

2014 to present

Supplement Petroleum Tax (SPT)

2016 to present

Financial Services Tax (FST)

2019 to present

Hotel Accommodation Tax (HOT)

2019 to present

Insurance Premium Tax (IPT)

2014 to present

-

Q: How do I file a return for periods not available online?

-

A: You will be required to fill out a paper return for income years not available via the Non-Logged In Returns Service. These returns can be obtained at IRD’s Regional Offices or on IRD’s website (http://www.ird.gov.tt/forms).

-

Q: Why am I not seeing the most recent filing period?

-

A: The filing periods will become available on the first day of the month following the end of the period. For example, PAYE Filing Period ending 31-Jan-2020 will become available on 1-Feb-2020.

-

Q: Can I prepare a return for a ceased or de-activated account?

-

A: Yes. Returns can be prepared for filing periods prior to the date the account was ceased.

-

Q: Can I save my return and complete it at another time?

-

A: Yes. Your return can be saved and will be available to you for editing up to thirty-one (31) days from the date saved. You must provide a valid email address in order to save the return. Please save the ‘Confirmation Code’ provided, as you will need it to retrieve your saved return.

-

Q: How can I retrieve my saved return request?

-

A: The saved return can be retrieved using the ‘Search for a Request’ link under the list of ‘Non-Logged In Services’ on e-Tax. You must use the email address provided when you saved the return and the ‘Confirmation Code’ that was given to you.

-

Q: Can I submit more than one return for the same filing period?

-

A: No. Multiple returns should not be submitted for the same filing period, as this will result in processing delays. Any changes to the return can be submitted as an objection.

-

Q: Can I submit a return on behalf of someone?

-

A: Yes. You can submit a return on behalf of another taxpayer. Please ensure that your contact information is provided on the return.

-

Q: I lost my Confirmation Code. How can I get it back?

-

A: You may contact IRD’s Call Centre at 800-TAXX and select option 1 to request your confirmation code. The email address used in filing the return must be provided.

-

Q: How do I submit supporting documents for my return?

-

A: During the preparation of the return, you will be prompted to attach the supporting documentation via the ‘Attach’ button or you can attach all documents online before submission. The required documents must be scanned and can be uploaded in any of the following formats: pdf, jpeg, jpg, png.

-

Q: I am filling out my return and I encounter a problem. What should I do?

-

A: You can contact IRD’s Taxpayer Relations Unit at 868-800-TAXX (8299) or send email enquiries to etax@ird.gov.tt

-

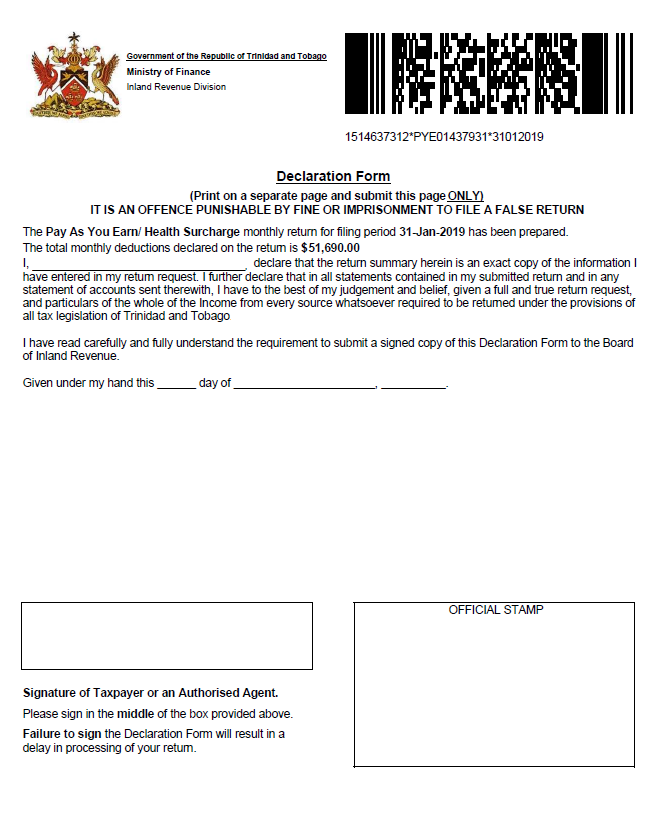

Q: Are there guidelines for printing the 'Declaration Form'?

-

A: This document contains two parts:

- The 'Return Summary Details' - kept by the taxpayer for their records.

- The 'Declaration Form' - signed and submitted to IRD. The Declaration Form will be retained by IRD once dropped off.

The guidelines are as follows:

- Use letter sized (8 ½” x 11”) white paper & 20lb-24lb,

- Print the ‘Declaration Form’ page on a separate sheet from the ‘Return Request Summary Details’ page.

- Print in portrait orientation only

- Print Actual Size or (100%) scale

- Print using black ink or full colour only

Please do not make any adjustments to the return before printing

-

Q: What should I do if my browser is disallowing the Declaration Form from being generated?

-

A: Some browsers do not allow pop up advertisement on web pages. If you are trying to generate the ‘Declaration Form’ and encountering this issue, please ensure that your pop-up blocker/ firewall settings permits the download from https://etax.ird.gov.tt.

The steps to verify that pop-ups are allowed are as follows:

For Google Chrome (recent versions):

- Go to Settings

- Select Show Advanced Settings link

- Under Privacy, select Content Settings, scroll to Pop-Ups

- Either "Allow all sites to show pop-ups" is selected or choose Manage Exceptions and ensure that https://etax.ird.gov.tt is on the list, if not add to list.

For Internet Explorer:

- Go to Tools

- Choose Internet Options

- Select Privacy Tab

- Ensure Turn on Pop-Up Blocker is unchecked or an exception is added for https://etax.ird.gov.tt

-

Q: I selected print my ‘Declaration Form’ but it was not generated, what should be done?

-

A: Please review the browser settings as described above.

-

Q: What should I do if I do not have a printer, computer, scanner or internet connection?

-

A: A limited service for individual taxpayers who are required to file returns, will be available by appointment only at Regional Offices from May 2020

-

Q: What are the signature specifications for the Declaration Form?

-

A: The signature must be prominent in the middle of the signature box provided. It must be done in either dark blue or black ink pen only. Signatures written in pencil will not be allowed.

Please note that failure to follow these instructions may result in a delay in the processing of your return since only sirnatures written as specified will be accepted.

-

Q: Who must sign the Declaration Form?

-

A: The Declaration Form can be signed by the taxpayer or authorized agent

-

Q: What if I lose my Declaration Form?

-

A: If lost, perform the following steps:

- Search for the Return via the ‘Search for a Request’ link on the e-Tax home page (https://etax.ird.gov.tt)

- Enter the email address used and the ‘Confirmation Code’ provided upon submission of the return.

- Select the ‘Print’ tab located on the top right of the page to reprint the ‘Declaration Form’.

-

Q: Which of the two (2) printed pages should I drop off at IRD’s Offices?

-

A: Only the page labelled ‘Declaration Form’ needs to be signed and dropped off. The ‘Return Request Summary Details’ must be kept for your records. Please see sample Declaration Form below (note that in this sample, the return was not finalized)

- Please note that all other attachments containing return information, for example Balance Sheets and TD4 information, must be scanned and attached via the ‘Attach’ button, when the return request is submitted online.

-

Q: Where do I drop off the Declaration Form?

-

A: The Declaration Form must be dropped off at any of the Inland Revenue Division Regional or District Revenue Offices. A list of the offices can be found at www.ird.gov.tt/locations.

-

Q: Can I make changes to my return after I have submitted the return but before I drop off the ‘Declaration Form’?

-

A: No. Changes cannot be made after the return has been submitted.

-

Q: When is the deadline to drop off the Declaration Form?

-

A: The Declaration Form must be dropped off before the due date of the return. See below for a guide on return due dates:

RETURN TYPE

DEADLINE DATE

Pay As You Earn

15th of the month following the end of the filing period or the next business day

Value Added Tax

25th of the month following the end of the filing period or the next business day

Corporation Tax

30th April of the year following the end of the filing period or the next business day

Individual Income Tax

30th April of the year following the end of the filing period or the next business day

Insurance

30th April of the year following the end of the filing period or the next business day

Partnership

30th April of the year following the end of the filing period or the next business day

Petroleum Profits Tax

30th April of the year following the end of the filing period or the next business day

Supplemental Petroleum Tax

15th of the month following the end of the filing period or the next business day

Hotel Accommodation Tax

31st of the month following the end of the filing period or the next business day

Financial Services Tax

15th of the month following the end of the filing period or the next business day

Insurance Premium Tax

15th of the month following the end of the filing period or the next business day

-

Q: My Declaration Form was submitted and I forgot to sign it, what should I do?

-

A: You will be required to sign and return to the Inland Revenue Division, a ‘Missing Signature Letter’, which will be sent to you via TTPost.

-

Q: How do I know if my return has been processed?

-

A: Taxpayers who submitted their returns via the ‘logged in service’ will be able to view the status of their return. However, those using the ‘Non-logged in service’ may need to make enquiries at the IRD’s regional offices.

-

Q: Can payments be made online?

-

A: IRD does not accept payments online at this time. However, the ‘Payment Description Slip’ (PDS) can be generated by selecting the ‘Pay Balance’ button and ‘Generate PDS’ after the return was submitted. This can be brought into IRD to the cashiering unit to complete the payment transaction.

At this time, this service is not available for non logged on PAYE payments. Payment Description Slips for PAYE needs to be be generated by IRD's counter clerk and then the payment can be made by the cashier.

An online payments service will be made available soon to taxpayers registered for e-Tax.

-

Q: Can I continue to use the PAYE and VAT Return Mail Subscription service?

-

A: No. From February 1st 2020, this service is no longer available. Additionally, PAYE and VAT returns will not be emailed to taxpayers who subscribed to the service.