PAYE Annual Return - Non-Logged In Guide - Account Information

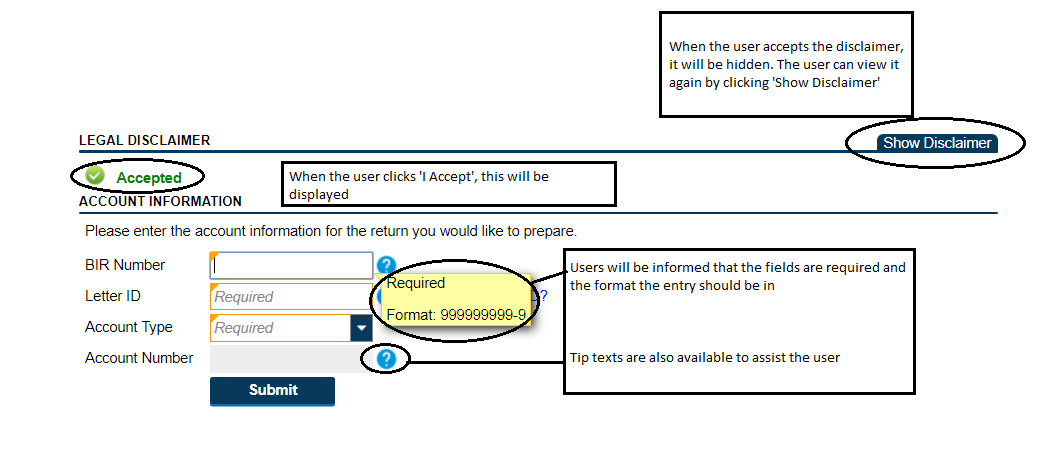

Once the Legal Disclaimer is accepted, the wording will be hidden and a check mark is displayed. The user may view the Legal Disclaimer again by clicking on the "Show Disclaimer" tab. The user will next have to enter details of the PAYE account they wish to prepare an Annual Return for; this will be used for verification purposes.

Have on hand, your BIR file Number, the PAYE Account Number, and a valid BIR Letter ID Number. A valid Letter ID number can be found on any of the following documents from the IRD

- ‘Official Receipt’ less than one (1) year old;

- ‘Advice of Assignment of BIR Number and Account Numbers’ less than six (6) years old.

Use the above information to fill out the form; mandatory fields are highlighted as “Required”. Hovering over the question mark to the right to a form field will show helpful tips that may help the user fill out that particular field.

If the information entered by the user does not match our records, this message will be displayed.

The user will be required to correct the information entered and resubmit. The user will not be able to continue until the Account Information is successfully verified.

To enter Account Information (Company BIR Number, PAYE Account Number, valid letter ID) and continue please click "Submit" In the image below.