e-Payments - Generate Payment Description Slip Service FAQs

-

Q: What is the “Generate Payment Description Slip” service

-

A: The Generate Payment Description Slip service allows taxpayers to generate and print a Payment Description Slip (PDS) online before visiting the IRD Offices to make the payments. Benefits to Customers / Taxpayers from this new service include:

- Faster processing time;

- Less time spent at the IRD offices to make payments;

- Having one less cashiering line to join i.e. Taxpayers with pre-printed PDSs can proceed directly to the Cashiers without joining the Customer Service Representative (CSR) line

Please see Question "How do I verify my PDS before going to the Cashier?" below for verification checks you can do to make the process easier.

-

Q: What is a Payment Description Slip (PDS)

-

A: The PDS is a document that describes the type of payment being made to a taxpayer’s account(s) and period(s). The PDS is not a receipt.

-

Q: Should I generate a PDS for payments of TT $100,000 and over using TransACH & safe-tt methods?

-

A: Yes, it is recommended that you generate the PDS. The unique media number can be included in the payment details in order to reduce the time in processing your payments.

Please visit e-Payments - Payments $100,000 and over for more information on payment via TransACH or safe-tt

-

Q: How do I access this service?

-

A: This service can be accessed from IRD e-services platform https://etax.ird.gov.tt

-

Q: Is this an online payment service?

-

A: No. This service will reduce the time taken by Taxpayers when making payments. Taxpayers with printed PDSs will not be required to join the Customer Service Representative line and will be able to go directly to the Cashiers.

Please note: IRD will soon be implementing an online payment service and the online PDS service will be an input into this online payment service.

-

Q: How do I verify my PDS before going to the Cashier?

-

A:

- Ensure that the $ amount on the PDS exactly matches the $ amount on your cheque

- Cash payments MUST be rounded off to the nearest 5 cent on the PDS

-

Q: How do I round off cash payments?

-

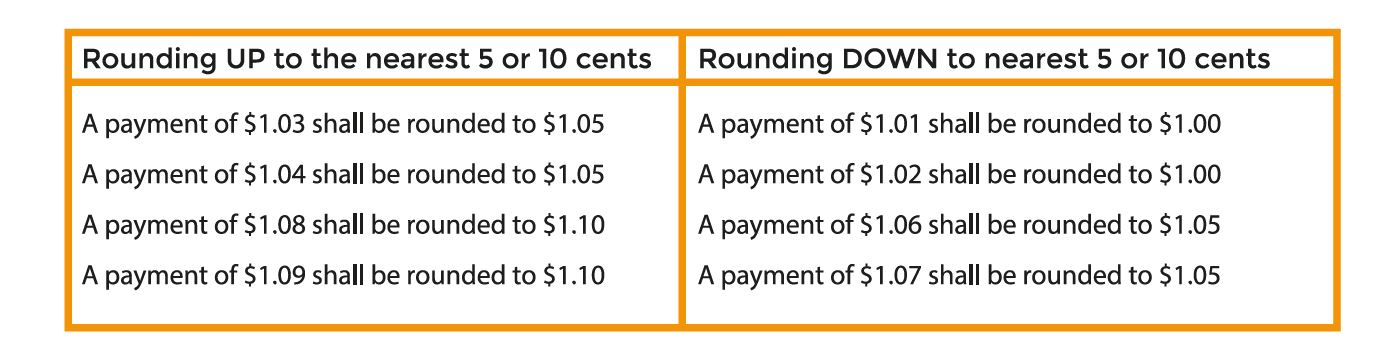

A: Rounding means the lesser or greater adjustment of a final cash payment to the nearest 5 or 10 cents in accordance with the rounding guidelines set out in the Table below:

For more information, please view the Central Bank of Trinidad & Tobago's Rounding Guidelines

-

Q: Do I have to register for the “Generate Payment Description Slip” service?

-

A: No. The “Generate Payment Description Slip” service is available to all taxpayers on both the e-Tax Logged-in and Non-Logged-in services. However, Customers interested in making payments for multiple Taxpayers on the same PDS will be required to use the e-Tax Logged-in service.

-

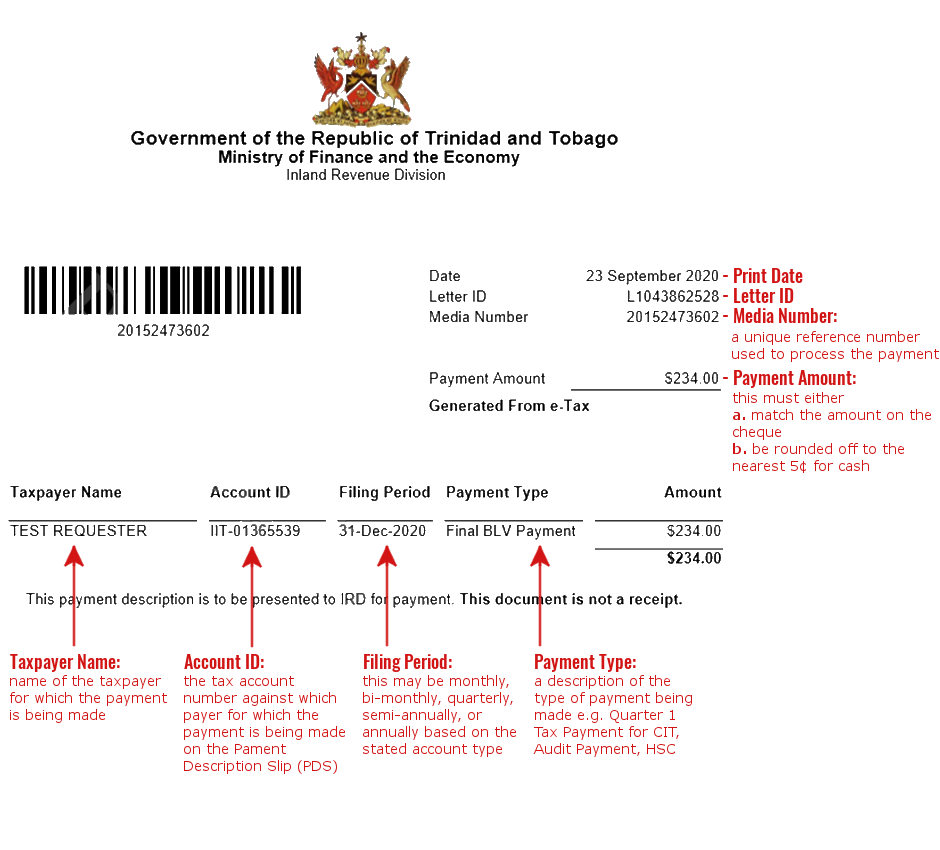

Q: What Information is captured in a Payment Description Slip (PDS)?

-

A:

- Date

- Letter ID

- Media Number

- Total Payment Amount

- Payment Details

- Taxpayer Name

- Account ID

- Filing Period

- Payment Type

- Payment Amount

See sample below:

-

Q: How do I include payment amount for penalty and interest?

-

A: There is no breakdown of the amounts on the PDS. You can calculate the penalty and interest using the table below.

TAX TYPE

PAYMENT DUE DATE

PENALTY & INTEREST CALCULATION

REMARKS

Pay-As-You-Earn (PAYE)

Payment is due by the 15th of the month following the month the deduction was made.

Penalty = 25% of deduction not remitted to IRD by the due date

Interest = 20% per annum on the amount not remitted plus the penalty

Period: 01-Jan-2020 to 31-Jan-2020

Return Due Date: 15-Feb-2020

Payment Due Date: 15-Feb-2020Value Added Tax (VAT)

Payment is due by the 25th of the month following the end of the VAT period.

Penalty = 8% on the amount outstanding

Interest = 2% on the amount outstanding from the day after the due date and an addition 2% on the first of every month thereafter on the amount outstanding

Period: 01-Jan-2020 to 29-Feb-2020

Return Due Date: 25-Mar-2020

Payment Due Date: 25-Mar-2020Corporation Tax

Payment is due by the end of each quarter, that is: March 31st, June 30th, September 30th and December 31sh.

Interest = 20% per annum from the day after the due date.

Period/Income Year: 2019

Return Due Date: 31-Oct-2020

Payment Due Dates: 31-Mar-2020, 30-Jun-2020, 30-Sep-2020, 31-Dec-2020Individual Income Tax – Self Employed

Payment is due by the end of each quarter, that is: March 31st, June 30th, September 30th and December 31sh.

Interest = 20% per annum from the day after the due date.

Period/Income Year: 2019

Return Due Date: 31-Oct-2020

Payment Due Dates: 31-Mar-2020, 30-Jun-2020, 30-Sep-2020, 31-Dec-2020Individual Income Tax – Emolument Income Earners only

Payment is due by April 30th following the filing year.

Interest = 20% per annum from the day after the due date.

Period/Income Year: 2019

Return Due Date: Not required

Payment Due Date: 30-Apr-2020Partnership - Green Fund Levy

Payment is due at the rate of 0.3% of gross income/receipts by the end of each quarter, that is: March 31st, June 30th, September 30th and December 31sh.

Interest = 20% per annum from the day after the due date.

Period/Income Year: 2019

Return Due Date: 31-Oct-2020

Payment Due Dates: 31-Mar-2020, 30-Jun-2020, 30-Sep-2020, 31-Dec-2020Petroleum Profit Tax (PPT)

Payment is due by the end of each quarter, that is: March 31st, June 30th, September 30th and December 31sh.

Interest = 20% per annum from the day after the due date.

Period/Income Year: 2019

Return Due Date: 31-Oct-2020

Payment Due Dates: 31-Mar-2020, 30-Jun-2020, 30-Sep-2020, 31-Dec-2020Supplemental Petroleum Tax (SPT)

Payment is due by the 15th of the month following the month the deduction was made.

Interest = 20% per annum on the amount not remitted

Period: 01-Jan-2020 to 31-Jan-2020

Return Due Date: 15-Feb-2020

Payment Due Date: 15-Feb-2020Financial Services Tax (FST)

Payment is due at the rate of fifteen percent (15%) by the 15th of the month following the end of the filing period.

Penalty = 50% of IPT not remitted to IRD by the due date

Interest = 15% per annum on the amount not remitted plus the penalty

Period: 01-Jan-2020 to 31-Jan-2020

Return Due Date: 15-Feb-2020

Payment Due Date: 15-Feb-2020Hotel Accommodation Tax (HOT)

Payment is due at the rate of ten percent (10%) by the last day of the month following the end of the filing period.

Interest = 15% per annum from the due date

Period: 01-Jan-2020 to 31-Jan-2020

Return Due Date: 29-Feb-2020

Payment Due Date: 29-Feb-2020Insurance Premium Tax (IPT)

Payment is due at the rate of six percent (6%) by the 15th of the month following the end of the filing period.

Penalty = 50% of IPT not remitted to IRD by the due date

Interest = 15% per annum on the amount not remitted plus the penalty

Period: 01-Jan-2020 to 31-Jan-2020

Return Due Date: 15-Feb-2020

Payment Due Date: 15-Feb-2020Notes:

- Where the due date falls on a weekend or public holiday, the due date shall be the next working day.

- Tax returns are available on e-Tax either as a logged-in service, that is either signing in via ttconnect (www.ttconnect.gov.tt), or as a non-logged-in service.

Eaxmple: If you wish to pay the following

- Tax - $700

- Penalty - $200

- Interest - $100

You will be required to enter the full amount of $1,000.00.

-

Q: What is the Account Type?

-

A: The Account Type is used to identify the various taxes administered by the Inland Revenue Division. A PDS can be generated for the following Account Types:

- Corporation Tax

- Financial Services Tax

- Green Fund Levy Tax Petrol

- Hotel Accommodation Tax

- Individual Income Tax

- Insurance Premium Tax

- Pay As You Earn

- Health Surcharge

- Petroleum Profits Tax

- Supplemental Petroleum Tax

- Value Added Tax

- Withholding Tax (Logged-in service only)

-

Q: Can I Save and print the Payment Description Slip (PDS)?

-

A: Yes, the PDS can be saved as a PDF file. When you are ready to make the payment, please print and take to the IRD office

-

Q: If I notice an error on the PDS after it has been printed, can I go back and change it?

-

A: No. Once the PDS has been printed, it cannot be changed. However, a new corrected PDS can be generated.

If you are in the Cashiering Line and discover an issue with your pre-printed PDS, the Customer Service Representatives will be able to amend the PDS.

-

Q: If I generate a PDS on the deadline day is the payment considered on time?

-

A: No, the PDS is not a payment. The PDS must be presented to one of IRD’s payment centers along with the method of payment i.e. cash, cheque, Linx®.

-

Q: Will I be able to view the Penalty and interest amounts if my payment is late?

-

A: No.

-

Q: Is the Payment Description Slip (PDS) a Receipt of Payment?

-

A: No, the PDS is not a Receipt of Payment. It is a payment Voucher, containing information, that can be used to make the actual payment.

-

Q: Will the Board of Inland Revenue issue a Receipt of Payment?

-

A: Yes, once actual payment is made at the IRD offices, the receipt will be issued.

-

Q: Is there a limit to the number of Payment Directions or payment amounts that I can create on a Payment Description Slip (PDS)?

-

A: No.

-

Q: Will I get separate receipts for each Taxpayer on my PDS?

-

A: Yes, separate receipts will be issued for each individual Taxpayer listed on your PDS.

-

Q: Can I create a Payment Description Slip (PDS) in a foreign currency?

-

A: No, only in Trinidad and Tobago Dollars ($TTD)

-

Q: Can I save a Payment Description Slip (PDS) and complete it later?

-

A: No, a Payment Description Slip must be Completed, or Cancelled if not used

-

Q: Can I delete a Completed Payment Description Slip (PDS)?

-

A: No.

-

Q: Does a Payment Description Slip (PDS) expire?

-

A: No. The Payment Description Slip does not expire. However, once it is used to make a payment, it cannot be reused.

-

Q: Can I view the payment updates against my account(s) using the e-Tax service?

-

A: ONLY taxpayers using the e-Tax Logged-in service will be able to view payment updates to their accounts.

-

Q: 25. Can I view a history of the Payment Description Slips (PDS) previously created using the e-Tax service?

-

A: ONLY taxpayers using the e-Tax Logged-in service can view a history of the Payment Descriptions previously created.