PAYE Annual Return - Logged In Guide - Save Progress

At any point after the PAYE Annual Return process is started and before it is submitted, the user may save their current progress using the buttons at the bottom left of the page.

- ‘Save and Continue’ button to save the return at its current state, and continue the process.

- ‘Save and Finish Later’ button to save the return at its current state, exit the process, and complete at a later time.

Save and Continue

On clicking 'Save and Continue', progress is automatically saved. The user is not required to do anything.

Save and Finish Later

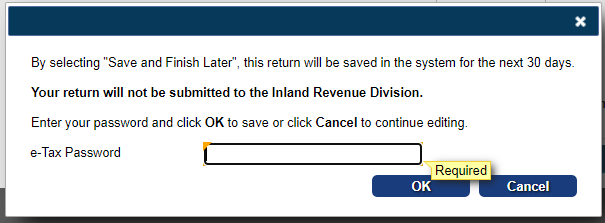

On clicking 'Save and Finish Later', the user will be required to enter their e-Tax password in order to save the return at its current state. Progress is saved when the user enters their e-Tax password and selects OK.

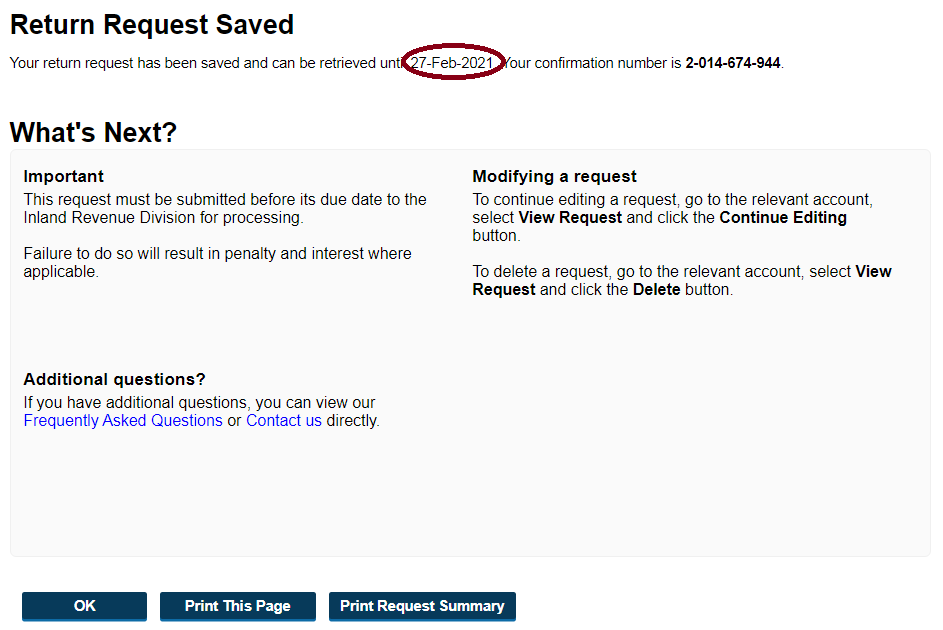

The user will then be shown the Return Request Saved page.

The date the return can be retrieved until will be given to the user along with a Confirmation Number. The return request must be retrieved by this due date otherwise the request is cancelled, progress will be lost, and the user will have to start the PAYE Annual Return process over.