PAYE Annual Return - Non-Logged In Guide - Save Progress

At any point after the PAYE Annual Return process is started and before it is submitted, the user may save their current progress using the buttons at the bottom left of the page.

- ‘Save and Continue’ button to save the return at its current state, and continue the process.

- ‘Save and Finish Later’ button to save the return at its current state, exit the process, and complete at a later time.

Save and Continue

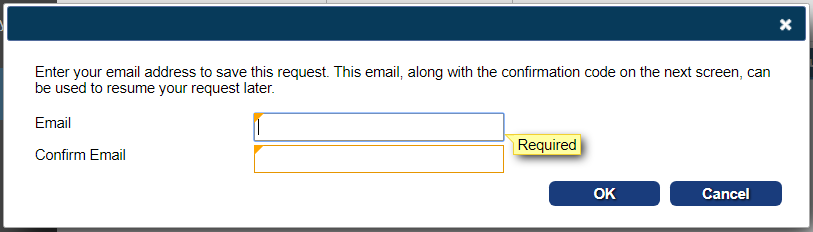

On initially clicking 'Save and Continue', a valid email address must be entered. The email address is necessary for the user to retrieve the return.

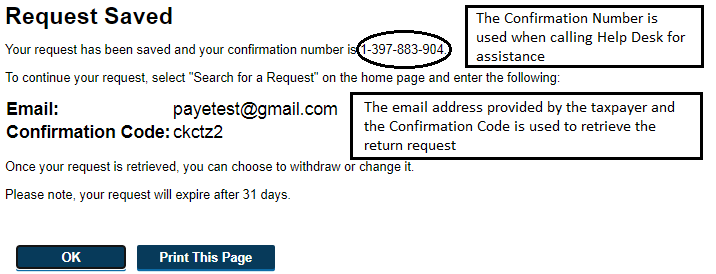

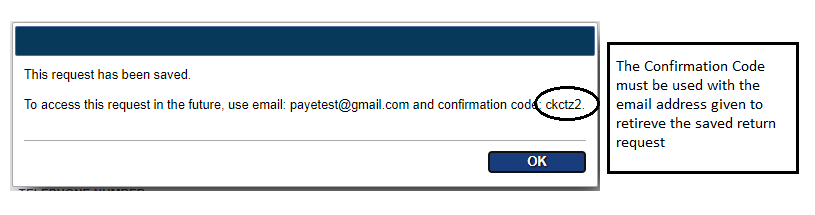

Once current progress is saved, a confirmation code to retrieve the return from the last saved point will be displayed. Please save the confirmation code. The confirmation code is used along with the email address previously entered to retrieve the saved return from the last saved point.

On subsequent clicks of 'Save and Continue', progress is automatically saved. The user is not required to do anything.

Save and Finish Later

The taxpayer can click the ‘Save and Finish Later’ button to save the return and complete it at a later time.

A valid email address must be entered and confirmed if the return was not previously saved.

Once current progress is saved, a confirmation code to retrieve the return from the last saved point will be displayed. Please save the confirmation code. The confirmation code is used along with the email address previously entered to retrieve the saved return from the last saved point.

The confirmation code provided, along with the email address used can be used to retrieve the request at a date up until thirty-one (31) days from the date it was saved. The return request must be retrieved within thirty-one (31) days otherwise the request is cancelled, progress will be lost, and the user will have to start the PAYE Annual Return process over.